Tina Sadowski

Phone: 716-675-2100 ext.190

Email: [email protected]

Health Savings Accounts or “HSA” are an investment account that your employer can establish to assist in covering costs related to qualified medical expenses. There are some key features to remember regarding your HSA benefits:

- Your HSA will follow you, even if you move or change jobs.

- When you utilize your account for qualified medical expenses, your HSA dollars are tax free.

- Your HSA can pay for your insurance deductibles and even for medical care that may not be covered by typical medical insurance plans.

How an HSA Works:

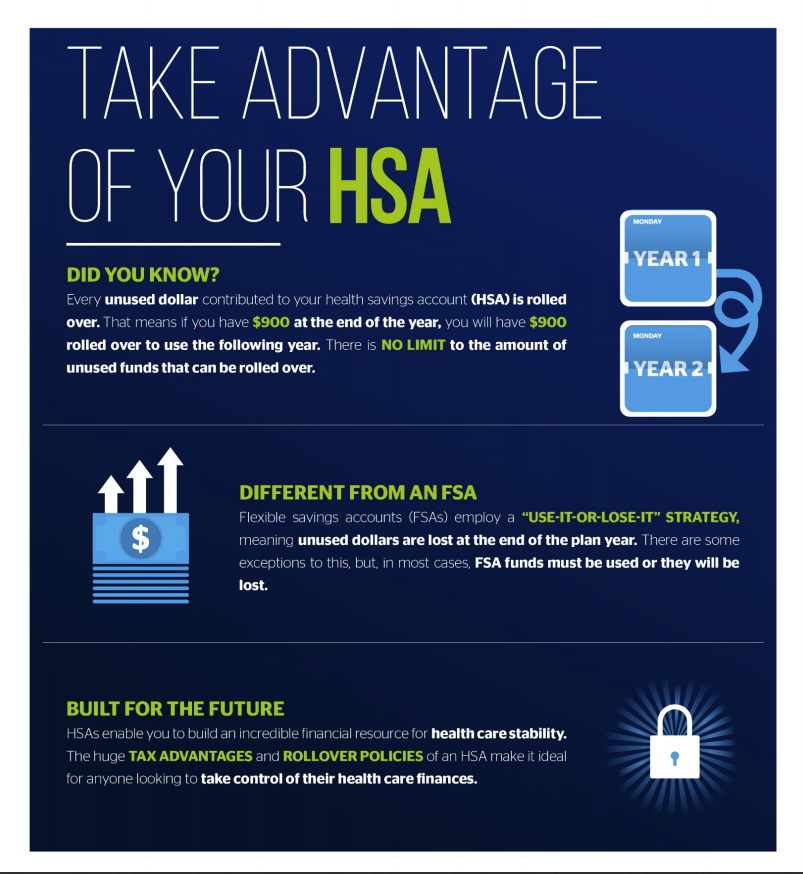

HSA’s are used in tandem with a High-Deductible Health Plan (In order to have an HSA, a participant must be enrolled in a qualified high deductible medical plan). HSA Accounts can be funded by both the employer and by employee contributions. These contributions are placed into an investment account and can be accessed to cover qualified medical expenses. In addition, these HSA balances roll over year after year. How you will be reimbursed: We will provide you with a “Benny Card” to access your HSA funds when paying for qualified expenses. The process is similar to paying for your groceries with a credit card. Simple, easy and efficient.

These numbers can speak to the popularity of HDHPs and HSAs, with HSA account holders contributing $22 billion to HSAs in just the first half of 2019: HSAs by the Numbers