The Coronavirus pandemic has created a challenging time for all of us. To ease the burden, we are providing a series of resources, including legal updates, HR tips and best practices, and useful links.

You can also follow us on Facebook, LinkedIn or Twitter for quick updates.

For additional information, please visit:

CDC - Coronavirus Disease

WHO - Coronavirus Advice for the Public

OSHA - COVID-19

NY Department of Health - Information on Novel Coronavirus

Small Business Administration - Coronavirus (COVID-19): Small Business Guidance & Loan Resources

IRS - Coronavirus-related paid leave for workers and tax credits for small and midsize businesses

Paycheck Protection Program - Borrower Information Fact Sheet

Returning to Work

We don't yet know when it will be safe to return to work, and that time is likely to come differently to everyone depending on location, industry, and guidance from the CDC and the go vernment.

vernment.

However, developing a plan now for a future return will but you and your business in the best position to hit the ground running when it's safe.

SAMPLE Return to Work Action Plan - This sample return to work action plan serves as an example plan for businesses to use as a template when preparing their own plans for reopening their business following the coronavirus pandemic. It does not account for state, local or industry-specific guidance related to COVID-19, but follows the guidance laid out by the CDC and OSHA that is designed to keep employers, employees and customers safe. Note: This plan will need to be customized prior to use.

Designing a Post-Coronavirus Office - Post-coronavirus, employers may want to consider how updates to an office can help protect the health and safety of employees. This article addresses updates to an office layout, behavioral changes and expansion of remote work.

Handling the Influx of Remote Work Requests - guidance for handling the influx of remote work requests as offices and work sites reopen.

Reopening Workplaces During COVID-19 Flow Chart - This chart is designed to help employers that are making decisions regarding reopening workplaces during the coronavirus disease (COVID-19) pandemic, following guidance from the Centers for Disease Control and Prevention.

EEOC Updates Employer Guidance on Coronavirus and the ADA - On June 17, 2020, the Equal Employment Opportunity Commission (EEOC) issued an additional answer to frequently asked questions (FAQs) about how employers should comply with the Americans with Disabilities Act (ADA) during the coronavirus / COVID-19 pandemic. The additional FAQ, which addresses antibody tests, was added to guidance that the EEOC originally issued on March 18, 2020, and updated on April 9, 17, 23, May 7, and June 11, 2020. This HR Compliance Bulletin contains the EEOC's FAQs. (Up to date as of June 17, 2020)

Legal Updates

Understanding the New $900B Stimulus Package - On Monday, Dec. 21, 2020, Congress passed an emergency stimulus package designed to deliver approximately $900 billion in COVID-19-related aid. Notably, the bill provides funding for unemployment benefits, small businesses, direct economic payments to individuals, vaccine distribution and rental assistance. This article provides an overview of what is included within the emergency relief bill. (December 22, 2020).

Comparing the Two Major COVID-19 Stimulus Packages - President Donald Trump recently signed into law an emergency stimulus package designed to deliver approximately $900 billion in COVID-19-related aid. This infographic provides an overview of the bill compared to the CARES Act passed in March 2020.

State Updates

State Updates - Employee Leave Requirements for Coronavirus - In the face of the coronavirus (COVID-19) pandemic, states have passed new employee leave laws and issued new regulations and guidance on existing leave laws and programs. This Compliance Bulletin briefly summarizes new state leave rules designed for workers affected by COVID-19. (Up to date as of March 30, 2020)

Coronavirus Preparedness and Response Supplemental Appropriations Act

Authorized $8.3 billion in funding for health care research and emergency preparedness for the Department of Health and Human Services (HHS), the US Agency for International Development (USAID) adn the Centers for Disease Control (CDC). It was signed into law by the President on March 6.

Families First Coronavirus Response Act (FFCRA)

Includes the Emergency Paid Sick Leave Act and the Emergency Family and Medical Leave Expansion A ct. It was signed into law by the President on March 18 and takes effect April 1.

ct. It was signed into law by the President on March 18 and takes effect April 1.

Families First Coronavirus Response Act Notice - Frequently Asked Questions - Under the Families First Coronavirus Response Act (FFCRA), covered employers must post a notice of the FFCRA requirements in a conspicuous place on its premises. This HR Compliance Bulletin includes frequently asked questions issued by the DOL on this notice requirement. (Up to date as of March 25, 2020)

New Coronavirus Relief Laws Require Paid Employee Leave: As part of sweeping legislation enacted in response to the coronavirus (COVID-19) pandemic, Congress has enacted two laws requiring employers to provide paid leave for coronavirus-related reasons. (Up to date as of March 25, 2020)

Coronavirus Bill Requiring Paid Employee Leave Signed Into Law: On March 18, 2020, President Trump signed into law a coronavirus relief bill requiring employers to provide paid leave for reasons related to COVID-19, among other provisions.

DOL Clarifies Exemptions to Coronavirus Paid Leave Laws - Small businesses and employers of health care providers or emergency responders may qualify for exemptions to the FFCRA paid leave requirements.

Coronavirus Aid, Relief and Economic Security (CARES) Act

Authorized $2.2 trillion to provide relief to individuals, small businesses, independent c ontractors, and major sectors of our economy that have been significantly impacted. The new law also includes several provisions affecting health plan coverage. It was signed into law by the President on March 27.

ontractors, and major sectors of our economy that have been significantly impacted. The new law also includes several provisions affecting health plan coverage. It was signed into law by the President on March 27.

CARES Act Expands Health Coverage Rules - On March 27, 2020, the U.S. Congress enacted the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to provide $2.2 trillion in federal funding to address the coronavirus crisis. The new law also includes several provisions affecting health plan coverage. (Up to date as of March 29, 2020)

Understanding the Historic $2 Trillion Stimulus Package - This document provides an overview of the $2 trillion stimulus package, which is designed to provide financial assistance for those struggling as a result of the coronavirus (COVD-19) outbreak. (Up to date as of March 27, 2020)

Coronavirus Stimulus Direct Payments FAQ - The CARES Act package will send direct payments to Americans. This article contains answers to questions employees may have about those payments.

Unemployment Benefits for Coronavirus under the CARES Act - The CARES Act provides federal funding for states to provide expanded benefits, including an additional $600 for certain weeks, under their unemployment insurance (UI) benefit programs. This Compliance Bulletin provides an overview of the UI provisions of the CARES Act and includes information about related guidance from the DOL. (Up to date as of April 8, 2020)

Relief and Information for Businesses

US Small Business Administration disaster loan information can be found HERE.

NYS FAQs for Businesses, including information about financial support, essential vs. non-essential business guidance, paid sick leave, and more can be found HERE.

Guidance on Essential Businesses and Executive Order 202.8 can be found HERE.

Information about the temporary suspension of State debt collection can be found HERE.

Tax Credits for Coronavirus Paid Leave: Employers with fewer than 500 employees may begin using two new refundable payroll tax credits to obtain reimbursement for the costs of providing coronavirus-related leave to their employees, the DOL and IRS announced on March 20, 2020. (Up to date as of March 23, 2020).

More information about coronavirus-related paid leave for workers and tax credits for small and midsize  businesses can be found HERE.

businesses can be found HERE.

The Paycheck Protection Program provides a small business a loan of up to $10 million for payroll and certain other expenses to allow employers to keep employees on their payroll. If certain requirements are met, up to 100% of the loan may be forgiven. More information can be found HERE.

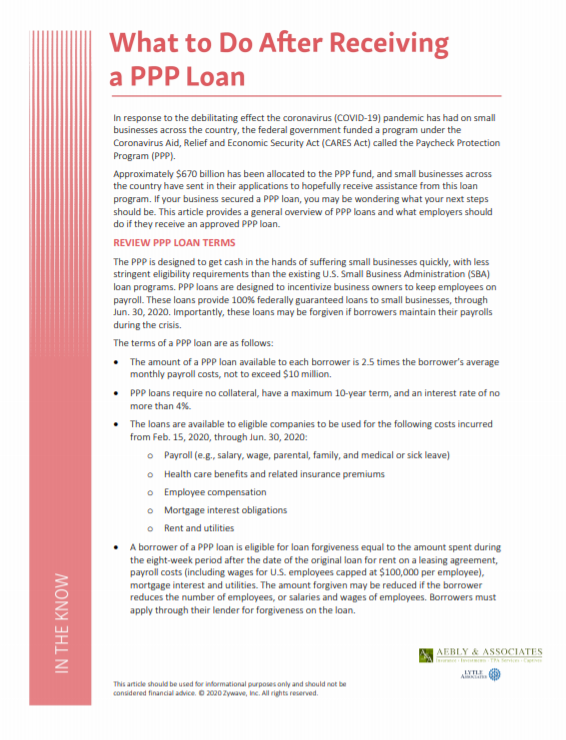

So, you have your PPP loan. Now what? What to do After Receiving a PPP Loan

The Economic Injury Disaster Loan (EIDL) Program provides low-interest loans of up to $2 million to small businesses and non-profits to help with temporary loss of revenue due to COVID-19. More information can be found HERE.

For details and a comparison of the PPP and EIDL Program, please visit: https://esd.ny.gov/small-business-administration-sba-covid-19-loans

Unemployment and COBRA

For business terminating employees and offering COBRA, please remember you must have at least 1 active member to offer COBRA.

Unemployed persons who can’t afford Cobra premiums can shop for health insurance through the exchange at https://www.healthcare.gov/

CHIP offers health insurance for children: https://www.medicaid.gov/chip/index.html

EPIC provides secondary coverage for Medicare Part D: https://www.health.ny.gov/health_care/epic/

An unemployed person can apply for NYS unemployment at: https://www.ny.gov/services/get-unemployment-assistance

Some employers in New York State are now required to provide at least five days of job-protected, paid sick leave to employees who need to take leave because they or their minor dependent child are under a mandatory or precautionary order of quarantine or isolation due to COVID-19. The amount of paid sick leave an employer is required to provide depends on the number of employees they have and the employer’s net annual income. For more information on NYS paid Family Leave visit https://paidfamilyleave.ny.gov/COVID19

If you test positive for COVID-19, are quarantined, and are unable to work, and/or are considered disabled during the period of medically required confinement, you may be eligible for NYS disability benefits. Contact your Human Resource department for more information.

Retirement

An Overview of Relief Provided for IRA Owners and Retirement Plan Participants by Pershing – The CARES Act provides special relief related to IRAs and retirement plans. For qualified individuals, this includes coronavirus-related distributions with exemption from the 10% early distribution penalty, as well as extended repayment and tax options. Speak with your plan sponsor to find out what options are available to you.

Employer Resources

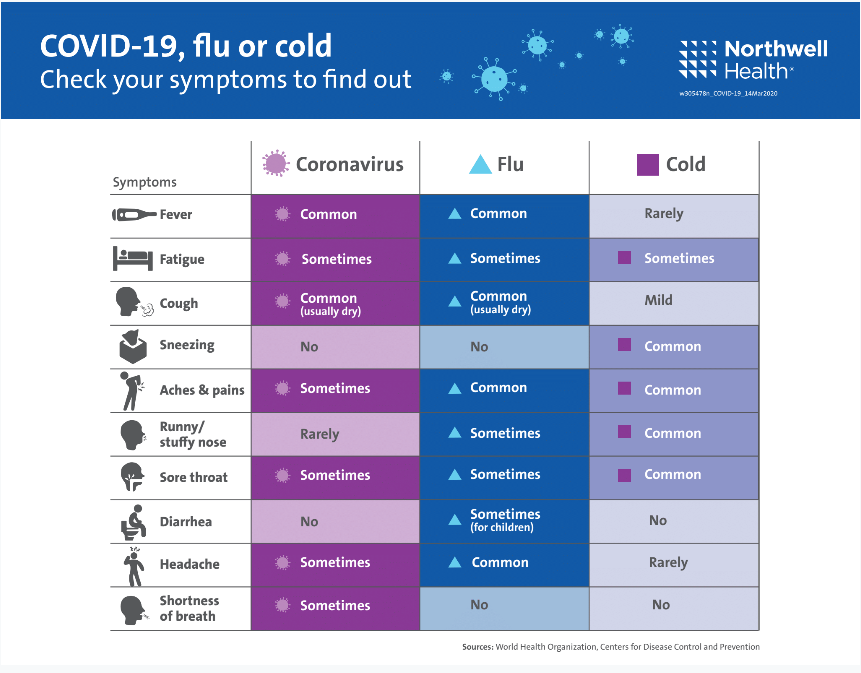

CDC Posters for the Workplace - Identifying the differences between COVID-19, the flu and the common cold; isolation vs. quarantine; risk factors and prevention; preparing your home; preventing the spread; signs and symptoms; etc.

DOL-Guidance on FFCRA Employer Leave Requirements - The federal Families First Coronavirus Response Act, enacted on March 18, 2020, requires employers to provide paid leave to workers for certain purposes related to COVID-19. This Compliance Bulletin contains guidance from the DOL about the new paid leave requirements. (Up to date as of March 25, 2020)

HR Insights - Best Practices: This HR Insights article provides tips for how your organization can address the coronavirus disease 2019 (COVID-19) pandemic

HR Insights - Coronavirus: Coronaviruses are fairly common and don’t typically affect humans. When they do, their effects are usually mild, as in the case of the common cold. However, deadlier variations of these coronaviruses have cropped up in recent years. This HR Insights discusses actions employers can take against these illnesses.

HR Compliance Bulletin - Coronavirus and the Workplace: As the number of reported cases of the novel coronavirus (COVID-19) continues to rise, employers are increasingly confronted with the possibility of an outbreak in the workplace. This Compliance Bulletin provides a summary of compliance issues facing employers in this situation.

Interim Guidance for Businesses and Employers to Plan and Respond to COVID-19: This guide provides information from the Centers for Disease Control and Prevention about how businesses and employers can plan for and respond to coronavirus disease 2019 (COVID-19).

5 Ways COVID-19 is Reshaping HR: With fluctuating infection rates and conflicting official guidance, organizations will need to adapt quickly if they want to succeed in the post-coronavirus landscape. This article includes five ways the coronavirus is reshaping HR and how departments can adapt to these new challenges.

Resources for Employees and the Workplace

Keep Surfaces Clean to Kill COVID-19: Cleanliness Poster

National Coronavirus Guidelines for Americans: 15 Days to Slow the Spread Poster

Step Away for Safety: Social Distancing Poster

COVOD-19, Flu, Cold or Allergies Flowchart: If you’re feeling under the weather, you may be wondering if you have coronavirus disease 2019 (COVID-19). Only a doctor can officially diagnose you with a condition, but using this flowchart can help you determine whether your symptoms are due to a cold or allergies, or something more serious.

Carriers

These links will keep you up to date on the coronavirus impact on claims processing and legal changes, answer FAQs, or just provide reassurance that your carrier is prepared for an emergency.

Important Notice on Health Insurance Premiums: DFS Issues New Emergency Regulation Requiring Commercial Health Insurers To Defer Payment Of Premiums Through June 1st For Consumers & Businesses Experiencing Financial Hardship During Covid-19 Pandemic

Aetna: https://www.aetna.com/individuals-families/member-rights-resources/covid19-employers.html

Aflac: https://www.aflac.com/individuals/advisories/covid-19.aspx

Ameritas: https://www.ameritas.com/newsroom/ameritas-responds-to-coronavirus-covid-19/

AmTrust: https://amtrustfinancial.com/resource-center/coronavirus-information

AIG: https://www.aig.com/about-us/coronavirus-updates

AllState: https://www.allstate.com/covid.aspx

Arch: https://www.archcapgroup.com/Business-Operations-COVID-19

AXA: https://www.axa-assistance.us/home

Blue Cross Blue Shield: https://www.bcbs.com/coronavirus-updates

Business Council of NYS: https://www.bcnys.org/managing-coronavirus

Chubb: https://www.chubb.com/us-en/chubb-statement-on-the-covid-19-outbreak.aspx

Cigna: https://www.cigna.com/individuals-families/health-wellness/topic-disaster-resource-center/coronavirus-public-resources

Cincinnati: https://www.cinfin.com/covid-19

COBRA Solutions: http://www.cobrainreview.com/newsletter/default.asp#1

Davis Vision: https://davisvision.com/

Dryden: https://www.drydennow.com/covid-19

Erie and Niagara Insurance Association: https://www.enia.com/Home/importantMessage

Excellus: https://www.chooseexcellus.com/covid19

Fidelis: https://www.fideliscare.org/Member/Helpful-Tools/Health-Resources/Coronavirus

Guard: https://www.guard.com/covid.html

Guardian: https://www.guardianlife.com/coronavirus

Hartford: https://www.thehartford.com/coronavirus

Independent Health: https://www.independenthealth.com/Coronavirus

Liberty Mutual: https://www.libertymutual.com/covid-19

Lincoln: https://www.lfg.com/public/COVID-19guidance?audience_page_id=1422918942386

Main Street America: https://www.msagroup.com/payment-suspension-request-info

Merchants: https://www.merchantsgroup.com/preparing-planning-coronavirus/

MetLife: https://www.metlife.com/COVID-19_US_Customer/

Millville Mutual: https://www.millvilleinsuranceofnewyork.com/index.html#modalWindow

Mutual of Omaha: https://blogs.mutualofomaha.com/brokerage/covid-19-response/

MVP: https://www.mvphealthcare.com/covid19

NYCM: https://www.nycm.com/pdf/ProcedureChanges_CustomerMessaging.pdf

NYSIF: https://ww3.nysif.com/en/FooterPages/Column1/AboutNYSIF/NYSIF_News/2020/20200320MessagetoOurPHs

Plymouth Rock: https://www.plymouthrock.com/blog/plymouth-rocks-commitment-to-safety-as-we-navigate-through-covid-19/

Principal: https://www.principal.com/insurance-coverage-and-covid-19

Progressive: https://www.progressive.com/support/covid19/

Reliance Standard: http://www.reliancestandard.com/SiteData/docs/RSLFAQ0325/bf83d112f619d212/RSL_FAQ03252020.pdf

Renaissance Family: https://renaissancefamily.com/alerts/coronavirus/

Selective: https://social.selective.com/coronavirus-advisory.html

SunLife: https://www.sunlife.com/coronavirus

Travelers: https://www.travelers.com/about-travelers/covid-19-coronavirus-update

United Healthcare: https://www.uhc.com/health-and-wellness/health-topics/covid-19

Univera: https://news.univerahealthcare.com/coronavirus

Unum: https://www.unum.com/covid-19

VSP: https://www.vsp.com/

As information is always changing, we cannot guarantee the accuracy of the information on this webpage at any given time. This webpage is not a substitute for professional legal advice.